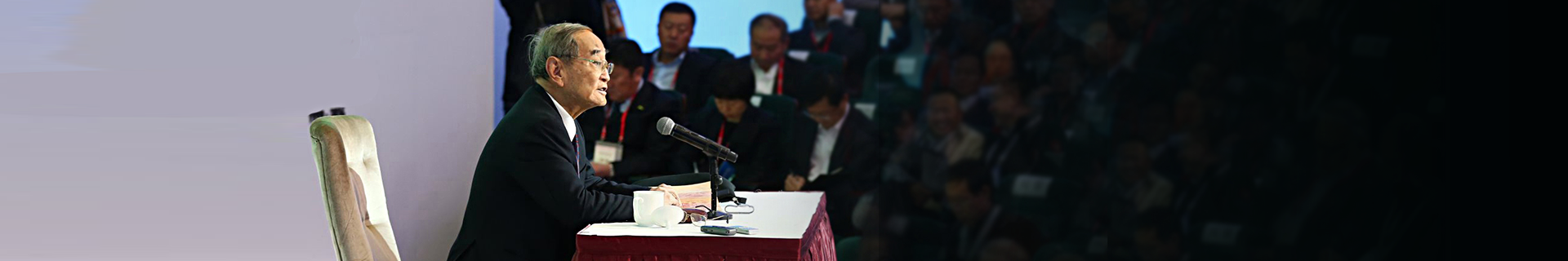

10��21������ΰ�ײ���ΰ�ײ�ͷ�������½����о�ϵ�б���ĵ�ʮһ�ݱ�����ʽ�������������۽����й���ļREITs�Ե�ĸܸ��������о�������

ժҪ��������ϵȫ��REITs����Դ�ṹ������ʵ���������ҹ���������ļ������ʩ֤ȯͶ�ʻ���ָ�������У����еĸܸ������������������������������ȫ��ʵ������������REITs�ܸ�����������������г�����������ģʽ����������������������������ڻ�����ʩREITs�Ե������������ܸ����ȵ��趨��Ҫ˼���г��������Ͷ���߲����졢REITs��Ӫ�������б���Ʒ��Σ���Լ�����ϵͳ�IJ�Э������������������������������������ĸܸ���Լ�����к���������������Ӻ������������Ҫ�������ҹ���ļREITs�г�������Ϊ���ʵ����ڼ��г������ܸ����ȵ��趨����Ҫ˼��Ʒ��Σ���ķ���������Ҫ˼���к�REITs��ֵ�������г�������Ӧ������REITsծ�ߺ�Ƿծ�����Ķ�Ԫ������������Ƿծ���ڹ������������г��Ľ�һ�����ƺ������ҹ���ļREITs�ܸ���Լ���������ϵ���Ŀռ�����

��Դ�ṹ����ָ��ҵ������Դ����ծ����Դ����Ȩ��Դ���ļ�ֵ��ɼ��������ϵ�����ǹ�˾��������Ľ������������ʲ�Ƿծ�ʣ�Ҳ�Ƹܸ��ʣ��Ƿ�Ӧ��Դ�ṹ�Ľ���ָ��������������ѧ��Myers��1984����������Э�ᣨAmerican Finance Association������ϯ�����н�����Ϊ����Դ�ṹ֮�ա��Ľ���������Modigliani and Miller(1958)�����ġ���Դ�ṹ���ۡ����������˼���⡪������ҵ��ʵӦ������ѡ��ܸ��������������������Դ�ṹ��Ϊ��������Դ�ṹ���ۡ��롰�����������ۡ�����˼���������ʹ��Դ�����Ϊ��˾��������ʵ����ѧ�����ձ����۵Ļ�������������ҵ����������������Դ�ṹ���н�����ҵ�ʽ�Ǯ����ֹ��ҵΣ��������������Ǯ��������ҵ���ŵȶ���DZ���洦�����Ӷ�������ҵʵ�ֹɶ���ֵ���������ط���ֵ���ı��Ŀ������������ھ��������������Դ�ṹһ��ƽ�⾭�������뾭��Σ����Ҫ��Ҫ������

���ɶ�������һֱ̽��ʵ�������й���ļ�������ʩREITs���ڳ˷���������2020��4��30�ա�������ļ������ʩ֤ȯͶ�ʻ���ָ��(����)������������壩������������������й���ļREITs���ƶȾ������ձ������������й���REITs�ܸ������������Ϊ�г���ע�Ľ�������֮һ����ƾ֤���������������������ʩ����ֱ�ӻ��Ӷ����������Ӧ�����ջ���ݶ��������������ԭ����������ܶ����ݻ����ʲ���20%���������;���ڻ�����ʩ��Ŀά�ޡ�ˢ�µȡ������г��ձ���Ϊ��Ҫ���REITsǷծ���ȹ��������ʽ���;��խ������8��7�������ġ�������ļ������ʩ֤ȯͶ�ʻ���ָ�������У����������Ի���Ƿծ�����ʶȷſ�����Ҫ����Ƿծ����������ʲ���28.57%����������Ƿծ�ʽ�����������Ŀ�չ�������Ӧ�˴�ǰ�г��������������

REITs��һ������Ľ����ƶȰ���������������֯��ʽΪ��˾���վ���ȯ����������REITs�ƶȾ���REITs������������ʲ��ṹ������ǿ�Ʒ��ɡ�˰���Ż�������Ҫ������Ȼ����REITs����Դ�ṹ���������������һ����REITs�ƶȵĻ���ȴ������ͬ�������������ձ����Ĵ����ǵȲ��REITs�ĸܸ��ʾ������������й���ۡ��¼��¡��¹���ΪREITs�趨�˸ܸ�����������Ӣ�����REITs����С��Ϣ���ֱ�����������������Ȼ�ڶ�REITs�ܸ��ʾ������ƵĹ������������趨�ĸܸ������ޱ���Ҳ���������������REITsҪ����ծ��������ʲ���45%��������2020��6�����������ز�Ͷ�����л���������ѯ�ļ��н��齫�ñ��ʷſ���50%�����¹�REITs���ʲ�Ƿծ�ʵ�������Ϊ66.25%�����¼�����2020��4�½�REITsծ���벻������ֵ�ı���������45%������50%��������������Ҫ���о����⣺���ƶ���ƵĽǶ�����REITs�Ƿ�Ӧ�����øܸ����������ܸ����ȵľ�ϸӦ������Щ���ؾ��������Ӧ���������������ҹ���ļ������ʩREITs�ĸܸ����趨�����

�ظ���Щ��������һ�������������ڶ�ȫ��REITs��Դ�ṹʵ���Ļ�����ʵ��������������������ڹŰ幫˾������Դ�ṹ���۵Ļ�������ϵREITs������ƶȰ��Ž���������REITs����Դ�ṹ�������������һ����������Ҫ����ҹ�����Ļ�����ʩ����Դ�г�����״̬����������˵�˼���к��ҹ��������ε����Ź�ļ������ʩREITs��Դ�ṹ������������ڴ��������ĵ����ݰ������������֣��ڵ�һ��������������ȫ��REITs��Դ�ṹ�й��ƶ�����ʵӦ�þ���������������������ڵڶ��������������ڲο��������Ļ�������ϵREITs�ƶȹ���REIT��ص���Դ�ṹ������������ڵ���������������ϵ�ҹ���ʵ�侰���ҹ�REITs�ܸ��ʻ�����������������������߽�������

һ��ȫ��REITs��Դ�ṹʵ��

ƾ֤Nareit��ERPA��ͳ��������ֹ2020��1������ȫ����42�����ҳ�̨��REITs�ƶ�����ȫ��ļREITs�г��ܹ�ģ��2������Ԫ����ƾ֤2020��9��ERPA�����ġ�ERPAȫ��REITs�Ӳ�2020��[1]��������������ȫ������һ������REITs�ƶ����й���Դ�ṹ�����ƺ�Ҫ������Ч������ĩ����1��ʾ����

ֻ�ܸ�����REITs�ƶȶ���Դ�ṹ�����ƺ�Լ��������ͬ�������������Թ�Ϊ���ࣺ1�������������ô��ձ����Ĵ����ǡ���������������������Ϊ�����Ĺ��һ����������REITs�ƶȶ�REITs��Դ�ṹ�е�ծ�������δ�����κ�������������ծ�����ʱ���ծ���˰�����þ���һ���������������2�����й���ۡ��¼��¡��¹���������Ϊ�����Ĺ��һ��������REITs�ĸܸ�����������Ҫ��REITs��ծ��������ʲ���������ֵ���Ļ��������������3����Ӣ����������Ϊ�����Ĺ��Ҳ������ܸ���������������REITs����Ϣ���ֱ���������������Ҫ��REITs���Բ�����ı������������Ƿծ��Ϣ��1.25���������4��������������������һ�����������������Ҫ��REITs�ĸܸ��������ɹɶ�����λ�ݶ�����ˣ�����ͨ�����ڲ������ƶ�����

���������һ����REITs�ܸ�������ƶȰ��ŷ���������ص�����һ����������7������������ҵ�����硢����ϵͳ�ϳ����G7�������������е¹�һ��������ȷ����˸ܸ���Ҫ������Ӣ��ֻ�ܶ�REITs������1.25���������Ϣ���ֱ�����������Ϣ���ֱ���������ζ��ֻҪREITs�ܹ������������ֽ���������������Ϣ�ͻ�Σ��������ծ��������Ϊ�Ͳ����κ������������ծ��ܸ�����Խ�����Ե�Լ�����������ڽ�������ˮƽ�����������˾�����������ӡ�ȡ�̩�������ɱ��ȹ����������ڻ���REITs�ܸ������Ļ����ϻ�������������ֶλ�������ֻ���к�����Ҫ���REITsʵ��Ż����ִ�ܸ��ʵ���������������REITs�������ڽϵ͵ĸܸ���Ҫ�������ڶ�REITs�ܸ��ʾ������ƵĹ����������ܸ������Ʊ����ڲ�����֮��ͬ������ϴ����������忴�ܸ�������λ��40%��80%֮����������������Դ�г���Ϊ���ŷ���Ҹܸ����������Խ������������¹�������������ʱ���������������ȹ��Ҹܸ�������������60%���������ӡ�ȡ�̩����ӡ��ȿ������������������ƶ���REITs�ܸ���������ͨ������50%����

��һ�����������г��ˮƽ֮�������ܸ�������ƶȰ���Ҳ������ģʽϢϢ������������������Ĵ����ǡ����������ô�ȶԸܸ��ʲ������ƵĹ��һ����������Ҫ�����ڲ�����ģʽ�������й���ۡ��¼��¡��������ǵ�ͨ���ϵ�ƶȶ�REITs��Դ�ṹ����Լ���ĵ䷶���������������ⲿ����ģʽ�������ڲ�����ģʽ��������ⲿ����ģʽ�µ�������ͨ�����и�רҵ�������������������ڼ���ģʽ��������ȯ���ش�����ͨ�����Ÿ��ߵ�������Ǯ�������ڲ���������������ⲿ���������Ÿ�ǿ����ͷͨ����ծʵ�ֵ����ڹɶ�����λ�ݶ�����ˣ���ֵ��REITs����������������������ͨ���ϵ���ⲿ����ģʽ�µ�REITs�ܸ��ʾ���Լ���ͱ�����Ҫ�������ձ�ֻ�����ⲿ������ΪREITs����Ҫ����ģʽ���������ϵ������Ȼδ��REITs�ĸܸ��ʾ��������������ܵ�Ե��ԭ�������ձ���Ͷ�����л���Ͷ����ռ������ְλ����ƾ֤OECD��2019�������ġ�����������ҵ����Ȩ���桷[2]�����ձ�������ҵ�з���ҵ���˻���Ͷ����ռ�ȵִ�37%����Զ�����й����12%���¼���12%���й�9%��ˮƽ������˼�����ձ������кܸ߱�������ҵ����Ͷ�����������ձ���С��˽��Ͷ���ߵı���Զ����������������������Ͷ�������С��˽��Ͷ���߹��ڽ���������Ǯ���и�ǿ�ļ�������������ʵ�ϴ����ձ�J-REITs�Ĺɶ�Ҫ��ͨ����˾�³̻��������ܸ��ʲ������55%��60%������ע����Ͷ����ֱ�滻�ϵ����ʩչ�˶�������Ǯ�ļ��Ӻ�����ְ������

��REITs����ʵı��������������������ѡ�����ŵ���Դ�ṹ�����ϵ�����Ƿ��Ӱ����Դ�ṹ��ѡ�����������Ϊȫ������REITs�г�����������������������REITs��ծ�����������ͼΪ����2000-2019���ÿ���ȼ�ĩREITs���REITs���й�˾��ƽ���ܸ���ˮƽ������������REITs�ϵҪ��һ�������˴�ʹ����ծ�������ʲ������ֵ֮�ȶԸܸ��ʾ���Ȩ������ֻ����2008��������������֮������REITs�ܸ��������½�����������20��������REITs��ҵ��ƽ���ܸ��ʾ���50%��60%֮�䣨��Ҫ˵����������ƾ֤Nareits��ͳ��������������ֵ������REITsȨ���ֵ������ô����REITs�г�20���ƽ���ܸ���Ϊ39%������������������ͬ�ڷ�REITs��ҵ20%-30%�ĸܸ���ˮƽ������Ч����Giacomini et al.(2017)�����Ч��һ������Giacomini et al.(2017)��������REITs����ծ�������ʲ��ܸ���Ϊ52%���������������ʲ�������ߵ�ǰ25%������ҵ�ĸܸ���Ϊ44%������ע��˼��REITs���нϸ߱������ο��ʲ��������и�ǿ���ʲ��ɵ�������һ��Ҫ����֮������REITs��Ȼ����ϸ߸ܸ����������������˼����������ʩ��һ�ײ��ʲ��ֱ������������ҵ�������������������Ľ�һ������������������ʩREITs�������ʩҵ����������ҵ��MLPs����ƽ���ܸ���ʱ����������������ʩREITs��MLPs������20�������ֳ��ܸ���һֱ���������������Ҿ���������������REITs��ҵ�ĸܸ���ˮƽ������������������������ʩREITs�ĸܸ���ˮƽ�ߴ�70%��������REITs�����ƽ���ܸ���������������ʩMLPs�ĸܸ�������REITs����ĸܸ���ˮƽ�������

ͼ1 ����REITs���REITs��ҵ�ĸܸ��ʱ��գ�2000-2019��

����ȪԴ��CRSP���ݿ⡢Compustat���ݿ⡢����ΰ�ײ�����������

��һ�������������һ������ҪREITs�г�REITs�ĸܸ�������������1������2019��β����Ҫ���һ������REITsƽ���ܸ����������м���ʹ����ծ�������ʲ������ֵ֮�ȶԸܸ��ʾ���Ȩ������Ч����ʾ��������Ҫ�г���REITsƽ���ܸ���λ��25%��45%֮��������������REITs�ĸܸ���ˮƽ���������ɸ���ȫ��������ҵƽ��20%-30%�ĸܸ���ˮƽ�����ձ����¼��¡��й����REITs��ƽ���ܸ��ʻ���Ϊ44.2%��35.6%��26.2%[3]�����ڶ�REITs�ܸ��ʾ���Լ������Ҫ�г��������¼���ƽ���ܸ�����ܸ����ϵ���ƵIJ��ȱ��10���ٷֵ��������й���ۡ�����ʱ���¹��ȵ��������REITs���ϵҪ������20���ٷֵ�������������������������Щ��Ϊ�����REITs�г���������δ������REITs�ܸ��ʾ������Ƶ��г�REITs�ܸ����������ڻ������Щδ��REITs�ܸ��ʼ������Ƶ��г�����

����ȪԴ��Bloomberg���ݿ⡢����ΰ�ײ�����������

�����������ծ����ڲ��ṹ���������г�������ṹ��Ԫ����ծ�����ڳ����������������ص���������REITs��������ͨ���ײ���Ŀ��˾�����е��ʲ����е��ʻ�����д�������REITs�Լ���Ϊ��������Ҳ����ͨ����ծ�ķ������������������ܸ���������������REITsΪ��������ֹ2019��β��������ծ���20.5%Ϊ��ҵ���д������������о���������ѭ�����ã�Revolving Credit Facility������ʽ�����ܹ�����ľ���ѭ���������������������仹���ڷ���������Ʊ������������ݰ��������ڶ���5�����������������й���ۡ��¼���Ϊ������������REITs�г�ʵ��������REITsͬ�����ɰ������ծȯ����תծ�����ڵĶ���ծ�����ʷ�����������չREITsΪ��������ֹ2019/2020����β��������ɵ�ծ�����ʷ����������д������Ʊ�����ת��ծȯ��������ռ��ծ���43.1%��45.6%��11.3%��������Լ����֮һ��ծ����������5����������������ծ��ṹѡ���ܹ����õ�ƥ��REITs�ʲ����ֽ���������������REITs�����ȹ��ֽ�������ֻ�������ծ����Ϣ���ֵ��ͻ����к�ǿ��ƥ��������������ծ�ֵ��ͻ����������������Ԫ���ľ�ծ�ṹ��������ծ�����ں���ݵ���ծģʽ������REITs����а�ؾ����ֽ������������Ӷ����Ͳ���Σ������

������Դ�ṹ������REITs�����Ӧ��

Myers(1984)����Ϊ����Դ�ṹ֮�ա��������������������Դ�ṹ�������롰������������������Baker and Wurgler(2002)����ġ��г���ʱ��������������˹�����Դ�ṹ������Ϊ��Ҫ��������������

��������Դ�ṹ��������Ϊ������ҵӦ��Ȩ��ܸ����������������������ѡ�����ʺ���ҵ����Դ�ṹ���������۵���Դ��Modigliani and Miller(1958)������������ġ���Դ�ṹ�ء���������Ϊ��ҵ�ļ�ֵ����ҵ���ʲ�����������������Դ�ṹ��Ӱ�������ڴ˻���������Modigliani and Miller(1963)��һ�����ծ�����ʾ���˰�ܼ�ֵ���������ҵ����ͷ���ծ�������Ȼ��������ҵ���ߵĸܸ��ʻᵼ�¸��ߵIJ��������������Ǯ��Baxter, 1967; Bradley et al., 1984�����������������ܸ���ѡ������ҵ����������ϢϢ�������һ����ܸ��ʿ��ܵ��¹ɶ�����������ծȨ�˺�˾��������ľ��飨Jensen and Meckling, 1976; Myers, 1977��������һ����ܸ��ʵ���������ͨ����̭�����ֽ�������ֹ��ҵ��������ʧ�Ȼ���������������ɶ�֮����������⣨Jensen, 1986������������������������ҵӦ���ۺ�ծ��������������˰�����桢��ҵ��Ǯ������������������Ǯ����ѡ�����ŵĸܸ�����

����REITs�������ƶȰ�����������Ӧ�þ������۾�������������������˼��ծ�����ʵ�˰�ܼ�ֵ��������REITsͨ������˰������ԭ������������Ϊ��������ǿ��Ҫ��REITs���ٽ������90%���ɸ�Ͷ�����ҷ��ɵIJ��ֲ���Ҫ����ҵ�����������˰�������ʹ��REITs������ͨ����ծʵ��˰���������ͷ����

�������˼�����������������Ǯ����ծ��ѡ���Ӱ�����������������ʱ������ծ��ΥԼ����ΥԼ��Ǯͬʱ�ܵ�ΥԼ������ΥԼЧ����������Ӱ����������ΥԼ���ʶ�����������REITs����ı���������ʲ�����������ͨ����ɢ��ı���ȷ�������Σ������ֻ��REITs�������ʲ���Ϊ�ܹ������ȹ��ֽ������ʲ��������ֽ�������ծ����Ϣ���ֵ��ͻ����к�ǿ��ƥ��������Ȼ���������ֽ�����������ծ�ֵ��ͻ��������������ծ����ʱREITs��Ҫͨ��ծ����Ȩ�����������Խ��»��������ھ��ò��������Ŵ����̵�ʱ������һ���ڽ����г��ϵ����ʷ�������������REITs�����ٽϴ�ı����ͻ�Σ��������һ��ΥԼ������������REITs�ƶȵ�Ҫ��REITs���ʲ���ͨ�����90%��Ϊ�����ȹ��ֽ�������IJ������������ڱ������������ʲ���������ʹ��REITs���ò���䲻�������б������������ܸߵ�ΥԼ��Ǯ����

��������˼��ծ�����ʵ����������������Ǯ����һ��������REITs�Լ�������ɸ߸ܸ˵ļ����������������Ͷ���˶�REITs��Ʒ��Ϣ�ʵ�Ҫ�����������˱���̫��ʹ�øܸ˵���ͷ�������������Զ�����߲�Ʒ����Ϣ���������������������������ģ�ҹ�����������Ҳ��ͨ��Ƿծ̫�����ŵļ���������һ������������REITs��������ǿ�Ʒ���Ҫ�������������ܹ�֧��������ֽ�����������ʹ��REITs��������������Դ���ʻ��ʲ�ѭ���������������������˻���������������ż��������������ծ�����ʵ�������ǮҪ����������������������������������ծ�����ʱ�Ǯ�����ʲ����ֽ����ر���������ô�����ܸ������������REITs�ķֺ�ر�������������������Դ�г����Ͽɶ����������������������ڡ�������Դ�ṹ�������������г����õ�����������REITs�����ʸܸ���Ӧ����ƽ��ΥԼ��Ǯ��������Ǯ֮���Ч������

�������������ۡ���Ϊ������ҵ���г�֮�䱣�����Ϣ��سƻ��������ӵ����ʱ�Ǯ��������������ʷ���֮�䱣������˳����ҵӦ������ѡ��ʹ���ڲ��ʽ������ڲ��ʽ�ȱ��ʱ����ͨ���Ŵ��������������ٴ��ǿ���ծȯ������Ʊ�������ھ�����ߵ���Ϣ��Ǯ����ĩ��ѡ������Shyam-Sunder and Myers(1999)��Fama and French(2002)�Ⱦ��ҵ���֧�ָ����۵�ʵ֤������������REITsǿ�Ʒ����ƶȶ���������ɵ���ͱ������Ҫ������REITs����������������֧��REITs����Ͷ�����������Ͷ����Ϊ�����������Ŵ���ծȯ���Ʊ���ⲿ��������ծ��������Ȩ�������Ƿ�����˳����������REITs�����˺�Ͷ����֮����Ϣ��س�ˮƽ����������������������ʲ��������REITs�ĵײ㲻�����ʲ���������ȹ̵��ֽ��������ʲ������Ƚϸ������ʲ���ֵ�Ŀ������Խϸ�������Щ����ʹ��REITs�����˺��ⲿͶ����֮�����Ϣ��س�ˮƽ�ϵ�����REITs��Ȩ���ʵĸ�����Ϣ������Բ�������������������˵����REITs����������Ϣ��Ǯ����ƫ����ծ����������

��Ҫ˵����������REITs���ھ��м��������ĵײ��ʲ����ȹ̵��ֽ�������ʹ���ⲿծȨ���ܹ����õ�������ծ��Σ��������ʵ������ҵ���еȻ���Ͷ����ͨ����REITs�ʲ���Ϊ������ʵ������Դ������REITs��ծ֮���γ����Ի�������һ������Щ����ΪREITs�ṩ�˵ͱ�Ǯ��ծ������������һ����REITsҲ��Ϊ��Щ�������Ժ�á�һ��Ͷ�ʵ����ʱ������

���г���ʱ�����۹�ע��Դ�ṹ�Ķ�̬����������������Ϊ���������������Ϣ����������ҵ���������г�����ҵ��ֵ�߹�ʱ����Ȩ���������������Ƿ�REITs������ҵ���REITs�������д���ʵ֤֤�ݶԸ����ۼ���֧��(Baker and Wurgler, 2002; Boudry et al., 2010)���������������REITs�����˵��г���ʱ��Ҫ����Ϊ�г������ֵת������Ǹ����ֵ������Ե��ԭ���վ�REITs����������REITs�ʲ�ͨ������רҵ�������Ƶļ�ֵ������������REITs�ĵײ��ʲ������������ϸ������������롢Ͷ������ֽ���������ʮ��ȷȷ������Ͷ��������Ҳ�Ǻ��Ͷ�ʻ�������ʹ��REITs��Ȩ���ֵ������������δ��������Ӧ�ֽ��������ֶ�����������С��REITs�IJ�ȷ���Ժ���Ϣ��س�ˮƽ������Ե�����Ͷ����ʹ��REITs��ֵ�����߹�������һ��ˮƽ��������REITs������ʹ����Ϣ�����ڹɼ۸߹�ʱͨ����Ʊ�г���������������

�ۺ�������������REITs��߸ܸ��ʵ�Ե��ԭ�ɰ���������߷ֺ�ر����������������˵���������ծ�����ʱ�Ǯ�ĵ͵�������������ƼӸܸ��������г�����REITs����Σ����������Ǯ�Ĺ�ע����

�����Ե��иܸ������������

��2020��4��30�ա�������ļ������ʩ֤ȯͶ�ʻ���ָ��(����)������������壩������������������й���ļREITs���ƶȾ������ձ������������й���REITs�ܸ������������Ϊ�г���ע�Ľ�������֮һ����ƾ֤���������������������ʩ����ֱ�ӻ��Ӷ����������Ӧ�����ջ���ݶ��������������ԭ����������ܶ����ݻ����ʲ���20%���������;���ڻ�����ʩ��Ŀά�ޡ�ˢ�µȡ������г��ձ���Ϊ��Ҫ���REITsǷծ���ȹ��������ʽ���;��խ������8��7�������ġ�������ļ������ʩ֤ȯͶ�ʻ���ָ�������У���������ָ���Ի���Ƿծ�����ʶȷſ�����Ҫ����Ƿծ����������ʲ���28.57%����������Ƿծ�ʽ�����������Ŀ�չ�������Ӧ�˴�ǰ�г��������������

��������ȫ���г�ʵ������Դ�ṹ���۵�Ӧ�������������ǿ��Թ��ɳ�����REITs�ܸ���ѡ����REITs�ܸ���������������ص��������⣺

��һ��������ǿ�Ʒ�����������REITs���������沢������������������ϣ��REITs���в���������ʱ�����ⲿ���ʾ��м��������������ô����Ӧ�������ܿػ�����ʩREITs���������������Dz��������е������������Ե�Σ�������

�ڶ���������REITs�����������ֽ�����ծ���ͻ�֮�䱣�����������REITs�����ʲ��ṹҪ������Ҫ�ʲ�Ϊ�����Բ��������IJ���������REITs���и��ߵ�ΥԼΣ����һ������ծ��ΥԼͶ���߽������ش��ΥԼ��Ǯ������ô�����Ƿ���Ҫͨ�����øܸ���������������REITs���������ٵ���ҵΣ�������

�����������øܸ�������Ϊ��REITs������Ϊ��һ��ǿԼ���������Լ��������ƽӰ�쵽REITs�г��ļ�ֵ���������

���ڵ�һ��������������Ӧ��������Ϥ���Ӻ���г���������Ʒ��Σ���ķ�����REITs�г��ϵ����Ҫ��������һ������������Ͷ���˶�REITs��Ʒ��Ϣ�ʵ�Ҫ�����������˱���̫��ʹ�øܸ˵���ͷ�������������Զ�����߲�Ʒ����Ϣ��������������������Ϊ��������REITs�IJ���Σ�����������һ����������������������ģ�ҹ�����������Ҳ��ͨ��Ƿծ̫�����ŵļ�������ͬʱ���DZ���Ҫ��Ϥ������REITs�ƶ��Լ����ṩ��һ��������������REITs����ǿ�Ʒֺ��ƶ�������һԼ�����������REITs��֧��������ֽ�������ʹ��REITs��������������Դ���ʻ��ʲ�ѭ�����������������˻���������������ż��������������������Ϊ����������������ܽ������ص��г������������ƶ��ܸ����������������Ʒ�����������������������������ⲻ��������ͬʱͶ������Գ�����г�������Ҫͨ��REITs�ֺ�Ҫ����г����ⲿ����������һ������л�Ӧ����

���ڵڶ������������Ӻ���г��������������ڳ����REITs�г���REITs���������ҵΣ����ȻӦ����Ͷ�����Լ��������Լ��������Լ��縺�����ñ�REITs���ֽ�����ծ���ͻ�֮��Ĵ��������ڲ������г����������Ŵ�����ʱ�������Ʒ��ҵΣ����������REITs��Ʒ�Կ��������ڲ������������������ǽ���������г�����Ͷ���߽��ܹ�������һ������������������Ͷ�ʾ�������Ȼ���������������REITs�г�������������ҹ��Ե�εĻ�����ʩREITs�г�����������Ҫ��������һ��Ͷ���߶Ի�����ʩREITs����Ϥ�����������Ϊ�����Ե��˳�����������Ҫע��Ͷ���ߵ�Σ���縺��������Ŀ�����ں�ô���һ��������г����������������������ҹ�����ϵͳ�Ա���һ���IJ�����������������REITs��õ�ծ�����ʹ��߰���ѭ�������(Revolving Loan Facility)������Ʊ��(MTN)��������Щ���߶�����ʹ����а�������������ص������ܹ���һ��ˮƽ����ֹREITsı���ֽ����������ͻ��ֽ�����ƥ������������������ҹ�������ʩ��Ŀ�����д�������ο�����Ϊ������������ڽ���������������Ҫ�����Ȼ�����Ϊ�������Ⱦ������������ʹ��REITs�ֽ���֧�����湥�������Ӵ���REITs��Ӫ��Σ������

����������ڵ�������������REITs�ļ�ֵ�����ǽ����ڲ������ʲ���ı��֮������REITs�ļ�ֵ�������ʲ��ĺ���ȹ̷ֺ������Լ���������Ӫˮƽ��ʹ���ʲ���ֵ�������������ʲ������Ƕ�����REITs������������;���������������ʲ�������ˢ�£����ʲ�ѭ����ͨ���ʲ�����ʵ������Ż���������������ӽ��ڵĽǶ���������ʹ��Ƿծ��������REITs����Դ��Ǯ�����Ǽ�ֵ�������ֶ�֮һ�������������ҵ����REITs�ʲ��˾��и���Ŀɵ����ʲ���������Щ�ʲ��ܹ�����һ�����ȹ̵��ֽ��������ڡ��ʲ�ͬ�ʻ����롰�����ʲ��ġ�ȷ�����侰��������Щ������ʩ�������еȽ��ڻ��������������ծ�����ʱ�Ǯͨ��Զ����Ȩ�����ʱ�Ǯ�������˼�����ҹ������г�Ͷ�������Ƶ���״����������ʩ��Ŀ���γ��жౣ��ծ����������������Ŀ�ĸܸ��ʾ���70%�����������Ǹܸ������ϵ�����ԭʼȨ���˾Ϳ��������ø����ʱ�Ǯ�ʽ��ͻ������ʱ�Ǯ�ʽ�������������������˿�����ͷ����Ҳ����һ��ˮƽ������REITs�г���׳������

REITs�������Ų���������REITs�г�ʮ���ձ��ʵ����������ij��ˮƽ�Ͻ���������רҵ������ʵ������������������������ʲ���������������������ʩ����Ч������Ҳ��һ��ˮƽ��������ʵ�ֵز��ʲ�����ɢ��������8��7�������ġ�ָ�������У���������������������С�80%���ϻ����ʲ����м�����ʩ�ʲ�֧��֤ȯ���зݶ��������Ϊ��80%���ϻ����ʲ�Ͷ���ڻ�����ʩ�ʲ�֧��֤ȯ���������������зݶ��������Ϊ�ҹ���ļ������ʩREITs���������Ŀ�չ��ṩ����������ӦǷծ�ʽ�Ҳͬ����������������Ŀ�չ�����

��������ۺ���������������ΪӦ�����ںͺ���ӽǼ����֮�ؿ����ҹ�������ʩ��ļREITs����Դ�ṹ������������

���������������Ե������������ܸ����ȵ��趨���˼�������г��������Ͷ���߲����졢����������Ӫ�������б���Ʒ��Σ���Լ�����ϵͳ�IJ�Э������������������������������������ĸܸ���Լ�����к������������

���Ӻ������������Ҫ�������ҹ���ļREITs�г�������Ϊ���ʵ����ڼ��г������ܸ����ȵ��趨������Ҫ˼��Ʒ��Σ���ķ���������Ҫ˼���к�REITs��ֵ�������г�������Ӧ������REITsͨ����Ԫ��ծ�ߺ�Ƿծ��������������ծ��ṹ���������������REITs��ص�����Ƿծ���ڹ��������Ӷ�ʹ��REITs�ܹ�����а�ľ����ֽ��������������������ֽ�������������IJ���Σ�����������¼��¡��й���۵ȹ��һ���������г�������ת���REITs����Դ�ṹҪ��һֱ������������δ���ҹ�REITs�����˵�רҵ������ְҵ����һֱ������REITsͶ���߾�������Խ�����졢��REITs�йص������ڹ���һֱ����������ϵ��������REITs�ϵ��REITs���еĸܸ���ʵ�������ҹ���ļREITs�ܸ���Լ������һ�����ϵ���Ŀռ�����

ΰ�ײ���ΰ�ײ�ͷ������REITs�����������������Ա���������Ρ���ῡ������١����ƺ졢��ܷ������ῡ���ˬ������������䡢��Ԫ�¡��ڼ��ġ�����巡���幵�����������ִ���ˣ���ῡ����Ρ�����巡�����������

�� �����

Baxter, N.D., 1967. Leverage, risk of ruin and the cost of capital. The Journal of Finance, 22(3), pp.395-403.

Bradley, M., Jarrell, G.A. and Kim, E.H., 1984. On the existence of an optimal capital structure: Theory and evidence. The Journal of Finance, 39(3), pp.857-878.

Boudry, W.I., Kallberg, J.G. and Liu, C.H., 2010. An analysis of REIT security issuance decisions. Real Estate Economics, 38(1), pp.91-120.

Fama, E.F. and French, K.R., 2002. Testing trade-off and pecking order predictions about dividends and debt. The Review of Financial Studies, 15(1), pp.1-33.

Myers, S.C., 1977. Determinants of corporate borrowing. Journal of Financial Economics, 5(2), pp.147-175.

Myers, S.C., 1984. The Capital Structure Puzzle. The Journal of Finance, 39(3), pp.574-592.

Modigliani, F. and Miller, M.H., 1958. The cost of capital, corporation finance and the theory of investment. The American Economic Review, 48(3), pp.261-297.

Modigliani, F. and Miller, M.H., 1963. Corporate income taxes and the cost of capital: a correction. The American Economic Review, 53(3), pp.433-443.

Giacomini, E., Ling, D.C. and Naranjo, A., 2017. REIT leverage and return performance: Keep your eye on the target. Real Estate Economics, 45(4), pp.930-978.

Jensen, M.C., 1986. Agency costs of free cash flow, corporate finance, and takeovers. The American Economic Review, 76(2), pp.323-329.

Jensen, M.C. and Meckling, W.H., 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), pp.305-360.

Shyam-Sunder, L. and Myers, S.C., 1999. Testing static tradeoff against pecking order models of capital structure. Journal of Financial Economics, 51(2), pp.219-244.

����1 �����һ����REITs�ƶȶ���Դ�ṹ��Ҫ��

[1] ��EPRA Global REIT Survey 2020��A comparison of the major REIT regimes around the world��

[2] De La Cruz, A., A. Medina and Y. Tang (2019), ��Owners of the World��s Listed Companies��, OECD Capital Market Series

[3] ��Ч����е�����2019�������ز�Ͷ�����л���REITs���о����桷�����Ч��44%��35%��26%ʮ�ֿ���������ע����ȪԴ�봦�óͷ����пɿ�������

[4] 2019��β�����¼��¸ܸ���������δ��45%�ſ���50%����

��������

�����濯�ص����ϼ��������������ο�֮��������������ñ����������ɵ��κ�Ͷ����Ϊ������Σ���縺��������

������ӣ�

��ļ������ʩREITs�����Ե��ص�����������̸���ֳɾ���

����ΰ�ײ�REITs����ʮ���й�REITs�г���������������

����ΰ�ײ���REITs���ƶ����蹺�Ⲣ��ס���ƶȵ���Ҫ����

����ΰ�ײ�REITs����ˣ��й�Ӧ�Թ�ļȨ����REITsΪ�����ص�����Ƴ��Ե�

����ΰ�ײ�REITs�����ߣ����Ҿ�����������ѹ��ʱ�Ƴ�REITs���������ھ����ȹ���ת������

����ΰ�ײ�REITs��������ȫ���REITs�������� �ɳ�Ϊ�������г���Ǯ֮��ê��

����ΰ�ײ�REITs�����壺����ļ����+ABS���ܹ����������������������õ�����ģʽ�����

���й���ļREITs������Ƥ�顷ȫ������

����ΰ�ײ������飺��������4�����й�REITs�г��������

����ΰ�ײ����й�����ס��REITs�г����������������

Ѱ���й��湫ļREITs�ġ���Ǯê������ҵ��������Դ�����Ӳ��о�